Huawei advocates for the accelerated evolution of African banking industry towards "uninterrupted" digital services

Huawei calls on the information and communication technology (ICT) industry and the banking industry to work together to address challenges such as unstable online services and the risk of virus invasion, and to promote the evolution of the African banking industry towards "uninterrupted services," "uninterrupted business," and "uninterrupted innovation.".

[Cape Town, South Africa, March 28, 2023] Recently, the Huawei Digital Finance Summit was held in Cape Town, South Africa. This summit mainly focuses on the digital transformation of the banking industry in Africa. Huawei has proposed the new concept of "Non stop Banking" around this theme. Huawei calls on the information and communication technology (ICT) industry and the banking industry to work together to address challenges such as unstable online services and the risk of virus invasion, and to promote the evolution of the African banking industry towards "uninterrupted services," "uninterrupted business," and "uninterrupted innovation.".

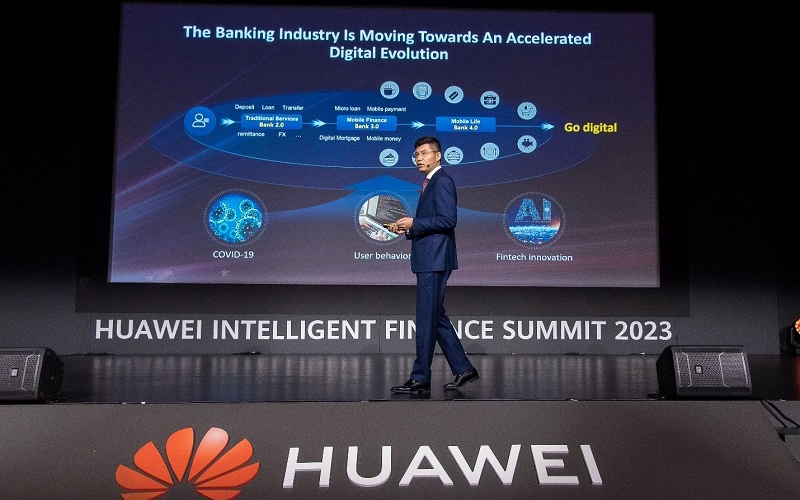

Chen Lei, President of Huawei's Southern Africa Division, pointed out in his keynote speech that digital transformation has become an imperative priority for the banking industry. In Africa, digitalization of the banking industry is still an important means to achieve inclusive finance, and therefore has even greater significance.

Chen Lei, President of Huawei Southern Africa, delivered a keynote speech at the Huawei Digital Finance Summit in 2023

Chen Lei introduced that Huawei has accumulated rich experience in the digital field of the financial industry. Specifically in the African region, Huawei can start from multiple aspects to assist the banking industry in achieving the goal of "uninterrupted" digital business——

Firstly, Huawei is committed to supporting the construction of ICT infrastructure in the African continent and helping more remote areas achieve digital connectivity coverage, which provides a soil for the digitalization of the African banking industry. Secondly, Huawei's pressure investment in research and development enables it to continuously introduce the most advanced technology to the African continent.

At the same time, at the technical level, Huawei's technological advantages in multiple fields such as storage, fiber optic networks, IP networks, and data communication enable it to provide banks with "multi domain collaborative" digital transformation solutions. For example, Huawei's "Storage Optical Collaboration (SOCC)" solution can shorten the system switching time after network downtime from 2 minutes to 2 seconds, ensuring zero interruption of banking business. For example, Huawei's Multi Layer Linkage Ransom Attack Protection Technology (MRP) can provide end-to-end protection for the network systems of banks. Huawei's "intelligent network operation and maintenance" solution can achieve fault detection in 1 minute, diagnosis in 3 minutes, and recovery in 5 minutes.

In addition, Huawei Cloud, as the world's fastest-growing major cloud service provider, can effectively support the "hybrid multi cloud" demand for digital transformation in the banking industry. Huawei's digital energy solutions can also provide reliable green power to bank customers, help African banking industry cope with power shortages, and support the "uninterrupted" operation of digital business in African banking industry.

Huawei Digital Finance Corps CEO Cao Chong delivers a speech at the summit

In his speech, Cao Chong, CEO of Huawei's Digital Finance Corps, also stated that Huawei is committed to providing services to financial industry customers in six major areas, including "transitioning from trading to digital interaction mode," "business agility and cloud native," "democratization of data capabilities," "secure and reliable infrastructure," "hybrid multi cloud LEGO style services," and "automated and predictable operation and maintenance." These technologies and services will help African financial industry customers accelerate their digital transformation, stimulate innovation, improve productivity, and achieve stable, agile, intelligent, and "uninterrupted" financial services, so that services continue, development, and innovation.